Proactively respond to threats

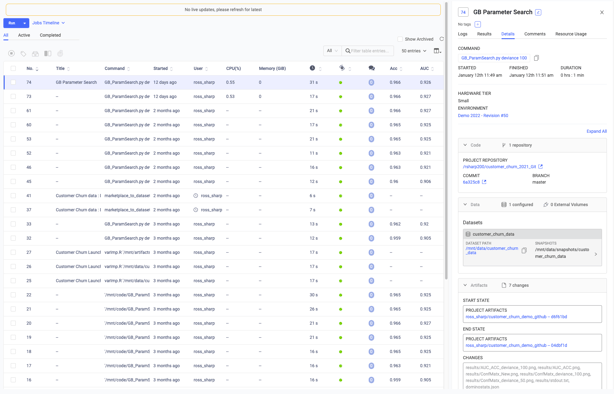

Increase model velocity and productivity to stay one step ahead of schemes and improve collections

Domino lets you proactively detect and respond to cyber, fraud, and money laundering schemes by accelerating the end-to-end data science lifecycle and increasing the productivity of data scientists and analysts.

Benefits:

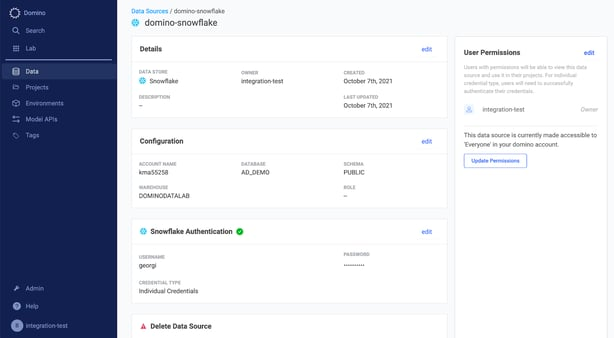

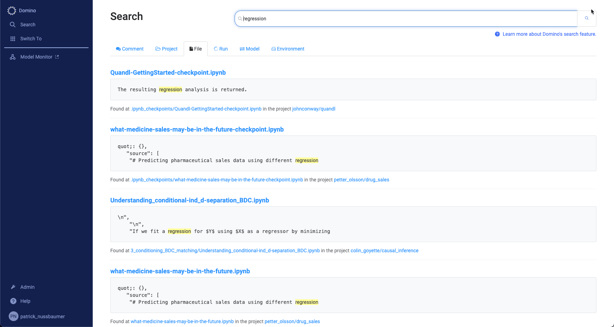

- Quickly access, consolidate and use data from structured and unstructured data sources.

- Rapidly build, deploy, and retrain models to keep pace with emerging threats.

- Automated alerting of degraded model performance.

- Easily embed models into business systems and processes.

- One-click access to powerful machines with the most popular distributed frameworks, including Spark, Ray, and Dask, and GPUs, accelerates training workloads.