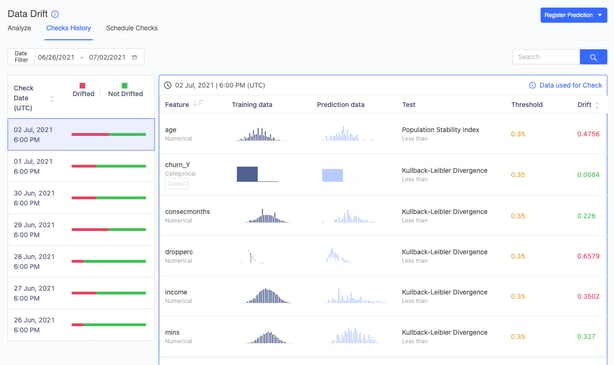

Manage model risk

Automate and standardize processes to holistically manage risk

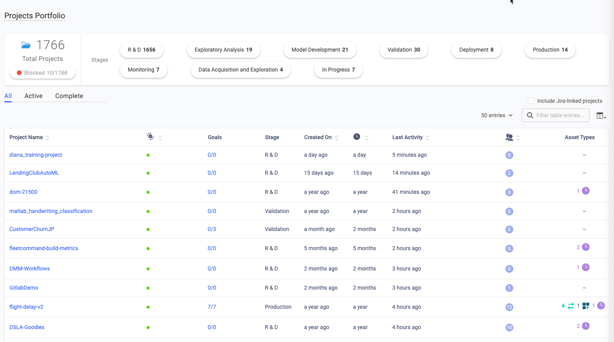

Domino helps you manage and streamline the end-to-end process for building a model, from idea to impact to validation while mitigating risks.

Benefits:

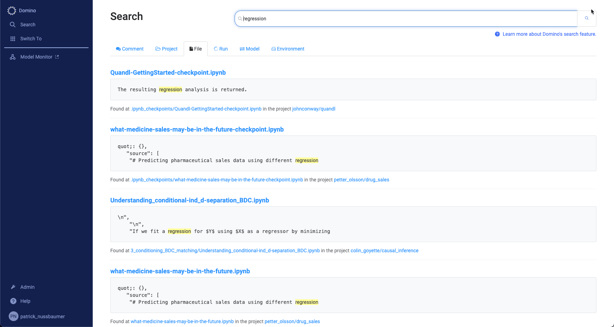

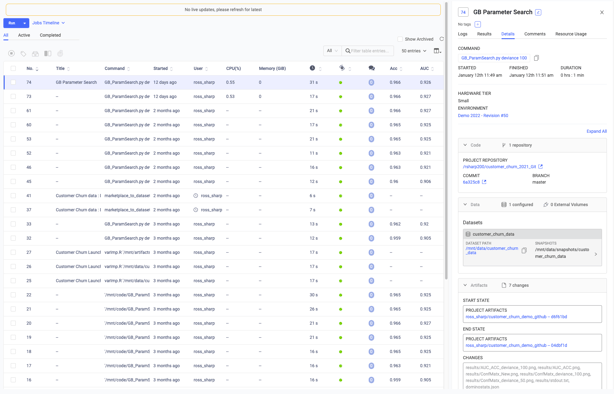

- Easily see relevant model management and validation workflow information.

- Centrally communicate model risk information to internal and external stakeholders.

- Codify and standardize risk, data science, IT, audit, and compliance processes.