Proactively respond to threats

Increase model velocity and team productivity to stay one step ahead of schemes

Domino lets you proactively detect and respond to cyber, fraud, underwriting, and money laundering schemes, and improve collections by accelerating the end-to-end data science lifecycle and increasing the productivity of data scientists, actuaries and analysts.

Benefit:

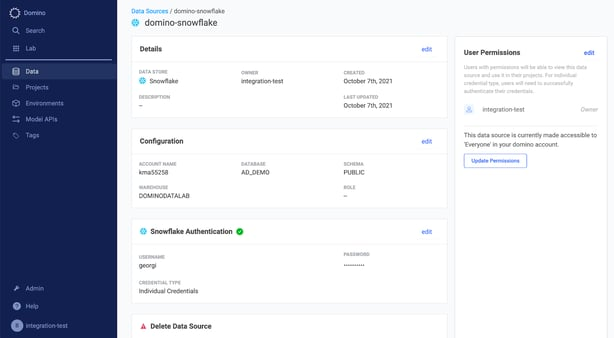

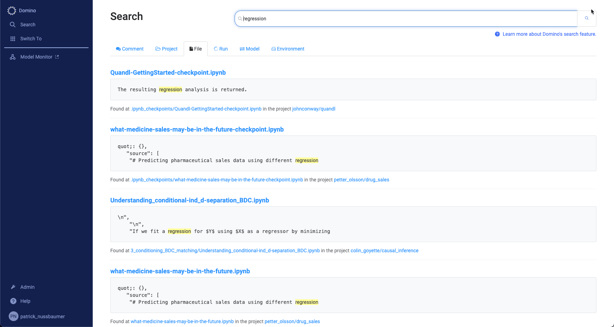

- Quickly access, consolidate, and use data from structured and unstructured data sources.

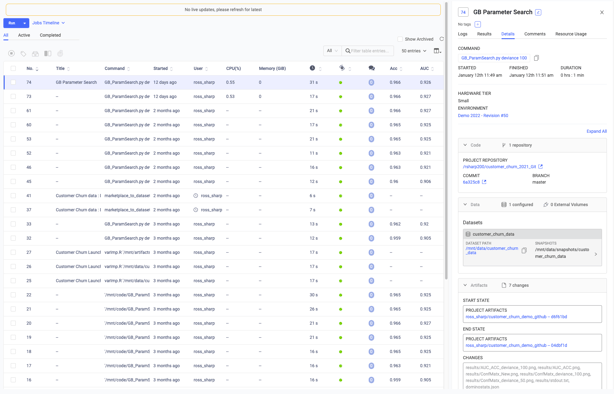

- Rapidly build, deploy, and retrain models to keep pace with emerging threats and changing conditions.

- One-click access to powerful machines with the most popular distributed frameworks, including Spark, Ray, and Dask, and GPUs, accelerates training workloads on large complex datasets.

- Automated model monitoring alerts you when model performance is degrading.

- Rapidly embed models into business systems and processes to drive business impact.